Taking out a payday loan is very serious business. When you haven’t taken one out in the past, learn all you can before you start. Doing research ensures that you understand your responsibilities before getting into a payday loan. Read on to learn the ins and outs of cash advances.

All payday loan agencies aren’t created in a similar way. Look around before settling on one. You may find one that offers lower interest rates or easier re-payment terms. You need to educate yourself about as many lenders as you can so that you can get the best deal and not end up end up regretting your decision.

Don’t make things up on your application when you apply for a payday loan. Lying on your application might be tempting in order to get a loan approved or a higher loan amount, but it is, in fact, fraud, and you can be charged criminally for it.

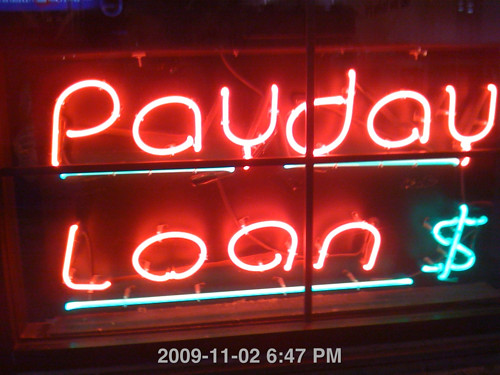

Payday Loan

You should always look into other ways of getting funds. Almost any source of credit (family loan, credit card, bank loan) is better than a payday loan. The fees for the choices mentioned is much less than what the charges are for a payday loan.

The limits to how much you can borrow with a payday loan vary greatly. This will be determined by your income. Lenders usually calculate how much you earn and then set a max amount that you can qualify for. This information can be helpful when determining whether you should get a payday loan.

There are many penalties for not paying on time, and you should be aware of this. You never know what may occur that could keep you from your obligation to repay on time. In order to know what the fees are if you pay late, you need to review the fine print in your contract thoroughly. Penalties can be big on payday loans.

Don’t think that you automatically have everything taken care of once you secure a payday loan. You should always keep any paperwork from the loan so you know the date it is due. If you miss the due date, you run the risk of getting lots of fees and penalties added to what you already owe.

Try to find a lender that provides loan approval immediately. If they aren’t able to approve you quickly, chances are they are not up to date with the latest technology and should be avoided.

Loan Company

Keep your account filled with enough money to actually pay back the loan. If you forget to make a payment, the loan company will try to get the money from the bank account you signed up with. Your bank will hit you with non-sufficient fund fees, and you will owe even more to the payday loan company. By ensuring that the money is in your account, you will be able to keep everything under control.

It’s important to know what you have to provide to your lender. Many lenders just need proof of income and your checking account information. Find out the information that you need to provide to make a safe and effective transaction.

Learn all you can before you take out a payday loan. If you’ve experienced the high interest and fees of a payday loan, you’re probably angry and feel ripped off. You must read the fine print and familiarize yourself with all the terms and conditions before accepting a payday loan.

If you are thinking about a payday loan, do as much comparison shopping as you can. Different companies will offer varying interest rates and applicable fees. You may have found a really great deal very quickly; however, there could be a better rate one click away. Don’t commit to any company until you have done your research.

Now that you have read this article, you know just how serious taking out a payday loan can be. Perhaps you feel you want to know even more, which means you should continue researching payday cash advances available to you. Use the information you just read to help you make the best decision for yourself.

Posted in

Posted in  Tags:

Tags: